Small Estate refers to the estate of the Deceased consisting wholly or partially of immovable property (land/building) not exceeding RM2 million in total value. There must be immovable property (e.g. land, house, or apartment) in the name of the Deceased for Small Estates (Distribution) Act (SEDA) 1955 to apply. The administration of a small estate is governed by the SEDA 1955 in Malaysia.

Applications are to be made at the Estate Distribution Unit of the Department of the Director-General of Lands and Mines (JKPTG) or the Land Office where the Deceased’s immovable property is located. If the Deceased’s immovable properties are located in several states, beneficiaries may choose one of the relevant district or state Land Offices to submit the application. The Land Office where the first petition is submitted will have the exclusive jurisdiction to resolve all of the Deceased’s estates located in all the other districts and states.

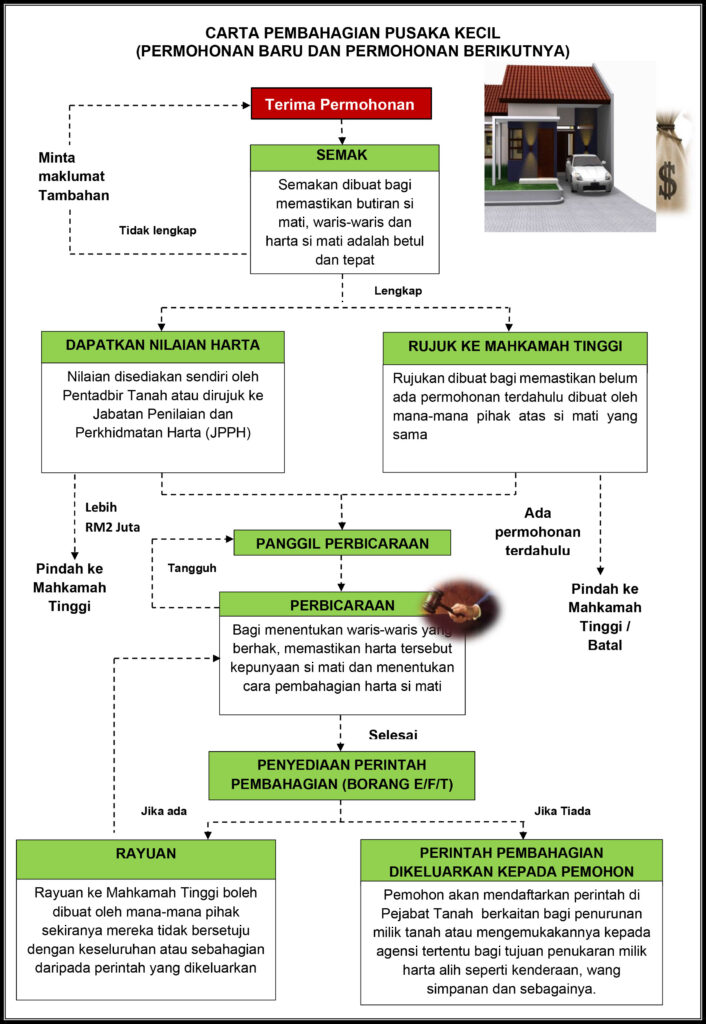

Application Procedures

The Applicant starts by completing Form A prescribed under the Small Estate (Distribution) Regulations. It is a simple form, available online or from the land office. In essence, it lists down all the assets and liabilities of the Deceased as well as his beneficiaries. After completing the form, it must be signed by the Applicant before a commissioner for oaths. Form A must be filed with the Land Office.

Petition/Application that has been processed will go for hearing. The Deceased’s beneficiaries and other relevant parties will be given a Notice of Hearing (Borang D/S) stating the date, time and place of the hearing.

The Applicant and other beneficiaries must attend the hearing, which will be conducted by the Land Administrator. Lawyers are not allowed to appear on behalf of any party before the Land Administrator except with the permission of the Land Administrator, who may grant or withhold such permission in each case as he thinks fit.

Any other beneficiary who is unable to attend may submit a letter of consent by completing Form DDA, available online or from the land office, which must be signed before a Commissioner for Oaths. Form DDA will specify the beneficiary’s wishes as to the distribution of the estate and may also opt to renounce his share in favour of another beneficiary. If the Land Administrator is satisfied that the beneficiaries are in consensus for the estate to be distributed differently, the Land Administrator can make an order according to the consensus.

Everyone attending the hearing must bring along their original identity card. The Applicant must also bring along the original of the other documents, copies of which were filed with the Form A. During the hearing, the Land Administrator will need to be satisfied with the particulars set out in the Form A, verify the identity of the Applicant and the beneficiaries, the assets and the beneficiaries’ entitlement. The Land Administrator will then proceed to grant LA to the applicant and to make an order for the distribution of the estate (Borang E/F/T). The distribution will generally be in accordance with the Distribution Act 1958, which determines the share each beneficiary is entitled to.

For immovable property where there is a separate title, the administrator of the estate has to forward to the Land Registry or Land Office the grant of LA together with the original property title, for transfer of the property to the beneficiary. The Distribution Order must be registered at the relevant Land Office(s) (state / district where the land title(s) is / are registered).

After the Distribution Order has been granted, if the Applicant intends to make any subsequent application such as to distribute the estate which was not declared earlier or to appoint a new Administrator, they may do so through Form P.

Any person aggrieved by the order or decision made by the District Land Administrator may appeal to the High Court.

Fees that are payable for the Grant of LA to be issued:

| RM10 | if the value of the estate is between RM1 to RM1,000 |

| RM30 | if the value of the estate is between RM1,001 to RM50,000 |

| 0.2% of the value of the estate | if it is more than RM50,000 |

Flow Chart

Source: Department of Director General of Lands & Mines Federal